It’s that time of year again when businesses brace themselves for the annual challenge of the year-end close. Whether it’s due to a lack of resources or time constraints, your finance department may find itself overwhelmed by manual tasks and processes. This is where Sage Intacct steps in, empowering you with the tools to simplify, streamline, and supercharge your year-end close process. By leveraging Sage Intacct, you can not only ensure accuracy and compliance but also provide peace of mind for your team. This blog will guide you through navigating end-of-year compliance and tax adjustments, simplifying 1099 e-filing, and seamlessly reconciling the general ledger to sub-ledgers. Learn how Sage Intacct can be the game-changer your finance team needs during this critical time of the year.

End-of- Year Compliance or Tax Adjustments

At the end of a fiscal year, adjustments are often made for compliance or tax purposes. You can configure your General Ledger module to include compliance adjustment journals, tax adjustment journals, or both.

Set up compliance or tax adjustment journals with three steps:

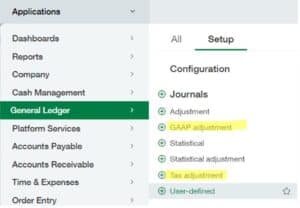

1. Go to General Ledger – > Setup – > Configuration

2. In the GAAP and tax section of the Configuration, check the box for ‘Enable GAAP adjustment journals’ and/or Enable tax adjustment journals.

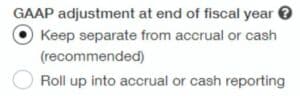

3. Review options in the GAAP adjustment at end of fiscal year section of the configuration. It’s recommended to keep the default selection of ‘Keep adjustments separate from accrual or cash.’

Once configured, add your compliance and/or tax adjustments journal types via General Ledger > Setup > Journals > Tax adjustment or GAAP Adjustment.

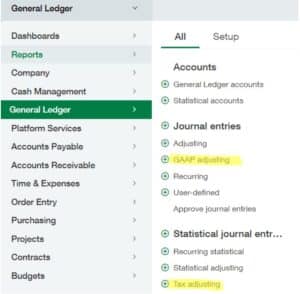

Create adjusting journals via General Ledger > All > Journal Entries > GAAP adjusting or General Ledger > All > Journal Entries > Tax adjusting.

Tax Bandits

Sage Intacct has partnered with TaxBandits to facilitate seamless 1099 e-filing, eliminating the necessity to export files or manipulate spreadsheet data. With the TaxBandits/Intacct integration, you can effortlessly share 1099 data with a simple click of a button, and then continue to the TaxBandits site to file the forms.

Additionally, TaxBandits offers the capability to file both state and federal forms, handle the mailing of forms, and provide online access to recipients.

File with Tax Bandits via the steps below:

- Subscribe to Sage Cloud Services via Company > Admin > Subscriptions > Sage Cloud Services

- Check the ‘Enable 1099 e-filing powered by TaxBandits’ checkbox in Accounts Payable > Setup > Configuration

- Create a TaxBandits Account using these instructions

- Go to Accounts Payable > All > 1099s > 1099 e-file submissions

- Select the appropriate tax year, filters & form and Click ‘E-File’.

This will redirect you to the TaxBandits website where you log into your account. After logging in, the batch will be sent to Tax Bandits. Once your file is submitted, you can e-file your batch within TaxBandits.

Subledger vs. General Ledger Reconciliation

Sage Intacct’s Customer Aging, Vendor Aging & Trial Balance Reports make year-end Subledger to General Ledger comparisons easy.

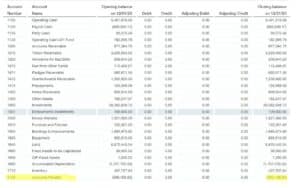

Run a General Ledger Trial Balance via General Ledger > All > Trial Balance to view your year-end Accounts Receivable Control Account Balance.

Run a Customer Aging Report via Accounts Receivable > All > Customer Aging > Report to view an AR aging report as of year-end.

Run a General Ledger Trial Balance via General Ledger > All > Trial Balance to view your year-end Accounts Payable Control Account Balance.

Run a Vendor Aging via Accounts Payable > All > Vendor Aging > Report to view an AP aging report as of year-end.

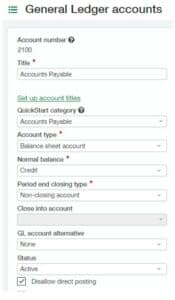

Intacct allows for the prevention of posting directly to the Accounts Receivable or Accounts Payable accounts via General Ledger > All > Accounts > General Ledger Accounts > Edit > Disallow Direct Posting. This feature prevents users from posting directly to any AP or AR control accounts.

At CompuData, we understand the importance of achieving a smooth year-end close, and that’s why we provide customized solutions tailored to align with your specific business requirements, empowering leverage the full potential of Sage Intacct. Our team of certified Sage consultants have the expertise, resources, and methodology needed to guide you toward a more streamlined and efficient year-end close with Sage Intacct.

To learn more about how your business can simplify your year-end processes with Sage Intacct, email us.