Sage Intacct’s 2025 Release 1 introduces powerful new features designed to enhance automation, optimize financial processes, and provide deeper insights for your business. From AI-powered tools to improved reporting and compliance enhancements, this update streamlines operations and helps you work smarter. Let’s explore the latest innovations in Sage Intacct and how they can drive greater efficiency for your organization.

Sage Copilot Close Assistant– Early Adopter

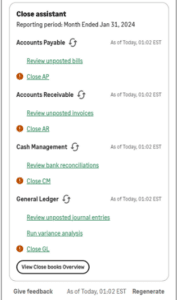

The Sage Copilot Close Assistant provides a comprehensive overview of your close process, offering visibility into the status of entities and subledgers all in one place.

At a glance, you can quickly check whether AR, AP, Cash Management, and GL have been closed for the period. Alerts will notify you if there are any bills, invoices, or journal entries that have been entered but not yet posted. From the Close Assistant panel, you can take immediate action, such as reviewing bank reconciliations, running Copilot Variance Analysis, closing subledgers and GL, and viewing the close books overview.

The Early Adopter program offers an opportunity to collaborate with Sage Intacct on key priorities. For more details about the Early Adopter program, please contact us here.

Enhancements to AI-Powered AP Automation with Purchasing– Early Adopter

AP Automation with Purchasing now includes support for standalone vendor bills and line-level matching as part of the Early Adopter program. You can configure transaction definitions to create automated transactions even without an existing source transaction to match. This is particularly useful for vendor bills that lack a corresponding Purchase Order or Purchase Requisition, such as utility bills or frequent purchases from preferred vendors.

You can choose to match Purchasing transactions at the header or line level. With line-level matching, line items are populated directly from the vendor bill, rather than from the source transaction. Machine learning also improves future predictions when updating transaction types.

Vendor-Based Bill Approvals

If your organization requires bill approvals based on vendors, Sage Intacct now offers a new vendor-based approval rule. This rule allows you to assign a specific approver to each vendor. When a bill is submitted, it is automatically routed to the assigned approver’s queue for review.

How it works:

- Assign the vendor-based approver type to your bill approval policy in the AP configuration.

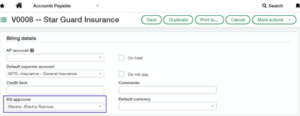

- The bill approver field now appears in the vendor record:

- Assign the approver manually or via import. Unrestricted business or employee users with appropriate permissions, or a user group (only one user in the group is required to approve the bill), can be designated as approvers.

- When a bill is submitted for a vendor with an assigned approver, Sage Intacct routes it to the approver’s queue for approval or rejection. If no approver is assigned, the bill is automatically approved, and the next approval rule is triggered.

Cash Management Enhancements

Enhanced Currency Support for Funds Transfers (Early Adopter)

Multi-currency companies can now process funds transfers involving up to three unique currencies without creating manual journal entries. When creating the funds transfer, simply enter the amounts sent and received—no need to input the exchange rate. Sage Intacct will select the most accurate rate and automatically create a rounding entry for any exchange rate differences.

NACHA-Compliant Payment Files

NACHA-compliant file formats improve efficiency and security of payment files uploaded to your bank. The NACHA-compliant ACH files are generated in Sage Intacct using the Bank File Payment menu.

The following ACH files have been added in this release:

- NACHA – Balanced with EOF marker

- NACHA – Balanced without EOF marker

- NACHA – Unbalanced with EOF marker

- NACHA - Unbalanced without EOF marker

Bank Transaction Assistant Supports Draft Payments

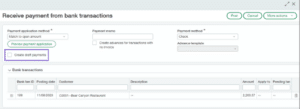

You can now draft customer payments that are not yet ready to be posted using the Bank Transaction Assistant. Additionally, payments can be drafted in bulk from the Posted Payments page in Accounts Receivable.

To create a draft payment, go to the Bank Transactions page, select a transaction to assign to a customer, and choose “Receive Payments.” Then, select “Create Draft Payments.”

Auto-Classification of Balance Sheet Accounts Based on Balance

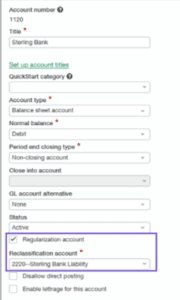

To comply with regional reporting requirements, you can now set up regularization accounts, which can be classified as either an asset or a liability on the balance sheet, depending on the account balance at the time the financial report is run. If the account’s balance differs from its normal classification, it will be eligible for reclassification. This feature should only be used if required for regional compliance.

When you designate an account as a regularization account, you must also specify its reclassification account. Sage Intacct will use this information to generate the necessary journal entries for reclassification, along with reversing entries for the following period.

How it works:

1. Enable regularization accounts in the General Ledger configuration and select the Regularization account classification journal.

2. Designate the regularization accounts in the General Ledger Account setup.

3. Run the GL regularization account reclassification report in General Ledger reports by following these steps:

3. Run the GL regularization account reclassification report in General Ledger reports by following these steps:

-

- The report includes only accounts designated as Regularization accounts, regardless of filter selections.

- When viewing or printing the report, you’ll have the option to create draft journal entries to move balances from regularization accounts to their reclassification accounts.

- If you process, store, or create a memorized report, you can select Auto-create draft JE when offline to generate draft journal entries automatically.

- Post the entries.

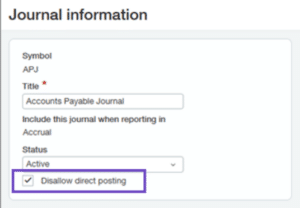

Disallow Direct Postings with Journals

To prevent discrepancies between subledgers and the General Ledger, a new Disallow Direct Posting checkbox has been added to the Journal setup page. When selected, users can no longer create entries directly through the Journal Entries page in the General Ledger. Instead, all entries must be posted through the subledgers. This setting also blocks Memorized Transactions and prevents journal entries from being created via import or the API.

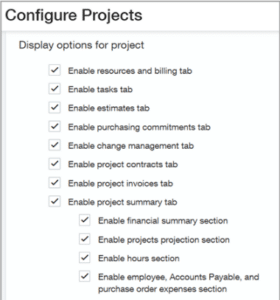

Streamlined Project and Grant Records

Streamlined project and grant records now provide quicker, more focused insights into billings and resource pricing. Sage Intacct has introduced new options on the Configure Projects page, allowing you to select the tabs you want to display on your project records.

Supplies Item Management

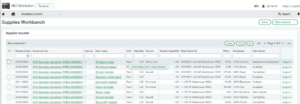

The Supplies Inventory feature offers an efficient way to manage employee supply requests and maintain accurate accounting as supplies are used. Supplies managers can easily review and fulfill requests, ensuring smooth operations.

In addition, the subscription provides valuable insights into purchasing and usage trends across locations and periods.

Employees submit requests when supplies are needed, and the supplies manager uses the Supplies Workbench to manage the following tasks:

- Review incoming supply requests and assess reorder needs based on high-demand items.

- Create new purchase orders or transfer in-stock items between warehouses.

- Replenish in-house stock of the most requested items.

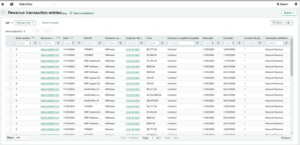

Automate Revenue Management when Billing from a 3rd Party Application

Automate revenue management for third-party billing by integrating Sage Intacct’s Revenue Management tools. The workflow starts when an invoice is created outside of Sage Intacct and imported into the system as a transaction. Users can then prepare and post the transaction lines from the new Revenue Transaction Entries page, ensuring accurate revenue impact, deferrals, and scheduled recognition by updating both the subledger and General Ledger.

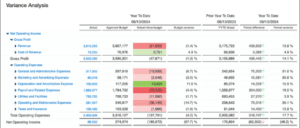

Variance Analysis Reports

New Variance Analysis reports are now available to help you assess budget performance by department or location. These reports are valuable for CFOs, controllers, department managers, or anyone tracking budget performance within the organization.

The reports are available in three versions:

- Variance analysis

- Variance analysis by department

- Variance analysis by location

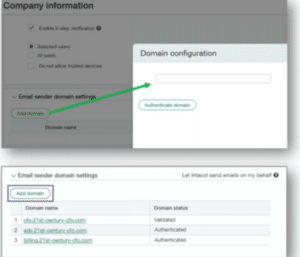

Authenticate and Validate Your Email Sender Domain by May 2025 for Enhanced Email Delivery Service

Starting in May 2025, all customers sending emails from Sage Intacct using a custom domain will need to authenticate and validate their domain. This is a key step as Sage Intacct transitions to the enhanced email delivery service, ensuring that your email communications are secure and reliable.

Authentication provides several benefits:

- Improves email deliverability, reducing the chances of your messages being marked as spam or not reaching recipients.

- Protects your domain from being used in phishing attacks or other fraudulent activities.

- Aligns with best practices for email security and compliance.

To avoid any email deliverability issues that might affect your communications to customers and partners, make sure to authenticate your domain by May 2025.

Steps to authenticate and validate your email sender domain:

- Add and authenticate the domain in Sage Intacct.

- Copy and save the DNS keys for reference.

- Add the DNS keys to your domain configuration.

- Validate the domain in Sage Intacct.

- Use a DNS checker to verify the DNS entries.

As Sage Intacct continues to enhance its features and functionality, your business can take advantage of these updates to improve operational efficiency, streamline processes, and gain deeper insights into your financial performance. By staying current with each release, you can maximize the value of Sage Intacct and unlock its full potential.

At CBIZ CompuData, we understand that every organization has unique needs. Our team specializes in delivering customized, intuitive accounting solutions designed to align with your goals. Let us help you leverage the power of Sage Intacct to optimize your business operations and achieve your objectives.

To learn more about how your business can benefit from the latest Sage Intacct updates, email us today.