As the year comes to a close, businesses face one of the most crucial and often stressful times of the financial calendar: closing the books. This process demands meticulous attention, thorough checks, and adherence to compliance standards. For many companies, the year-end close is marked by tight deadlines, high stress, and the risk of errors that can impact financial reporting and decision-making. Without the right tools and processes, the end-of-year close can become a bottleneck, slowing operations and adding strain to your finance team.

Modern accounting technology can make a significant difference. By leveraging an advanced cloud-based solution like Sage Intacct, businesses can streamline their year-end close, ensuring accuracy, efficiency, and compliance. In this guide, we’ll walk you through the essential steps of the year-end accounting process and show how Sage Intacct can be the game-changer your finance team needs.

1. TaxBandits Integration Updates: Streamline Year-End Filing

Year-end tax filing can be stressful, but with the Sage Intacct and TaxBandits integration, you can streamline the 1099 e-filing process, reducing manual effort and minimizing errors. This integration allows you to effortlessly share 1099 data with just a click.

Over the last 12 months, TaxBandits has made significant improvements to its platform, focusing on automation, user experience, and integrations. These enhancements provide substantial value to businesses, especially when paired with Sage Intacct.

Here are some key updates and how they seamlessly integrate with Sage Intacct:

Enhanced E-filing Capabilities

One of the most notable updates is the expanded e-filing capabilities. TaxBandits has broadened the range of forms that can be e-filed, including various state and federal tax forms. This allows businesses to file a variety of tax forms directly through the platform, minimizing the need for paper filings or separate e-filing systems. Sage Intacct customers can now sync their financial data effortlessly with TaxBandits to file W-2s, 1099s, and other essential forms, saving both time and effort. This enhancement ensures data accuracy, allowing businesses to e-file all necessary forms with just a few clicks

Watch a step-by-step video tutorial on submitting 1099 forms to the IRS using TaxBandits here.

Real-time Tracking and Status Updates

TaxBandits has introduced a robust tracking system for tax filings. Users can now track the status of their submissions in real time. Whether a form is in progress, submitted, or accepted, users can easily monitor each step of the filing process through the TaxBandits dashboard. This integration ensures businesses stay on top of filing status and keep their internal systems synchronized.

Multi-State Filing Made Simpler

Another critical enhancement is the improved multi-state filing functionality. Tax Bandits has expanded its capacity to manage and file taxes across multiple states, ensuring that businesses with multi-state operations are compliant without the headache of handling different tax rules for each state. For customers managing multi-state operations, this feature provides an easy and efficient way to file tax returns in all relevant states without manual tracking of different rates or deadlines. The integration helps automate the process and ensures compliance in each state by pulling the necessary data directly from Sage Intacct into Tax Bandits.

Streamlined 1099 Compliance

TaxBandits has also improved its support for 1099 compliance. New tools for tracking independent contractor payments and enhanced e-filing for 1099 forms make it easier for businesses to stay compliant with IRS requirements. Businesses using Sage Intacct can leverage its enhanced reporting and payment tracking features to quickly identify contractors and service providers who need a 1099, then file the forms seamlessly through TaxBandits.

Enhanced User Interface and Experience

Tax Bandits has revamped its user interface to be more intuitive and easier to navigate. From simplified workflows to a cleaner design, these changes make it easier for businesses to manage tax filings efficiently. For Sage Intacct customers, the enhanced user interface streamlines the entire process, from importing data to filing forms. The intuitive dashboard, combined with seamless integration, ensures that businesses can manage their tax compliance more efficiently without the steep learning curve.

The Value of Sage Intacct Integration

Tax Bandits’ enhancements over the last year, coupled with its robust integration with Sage Intacct, offer businesses a powerful tool for handling tax filings with precision and efficiency. The integration ensures that businesses can easily sync financial data, file accurate forms, track the status of their filings, and maintain compliance across states. For businesses using Sage Intacct, these enhancements save time, reduce the risk of errors, and ultimately contribute to a smoother tax filing process.

2. User Role Assignments Reports

If you’ve ever been through an ERP audit, you know that auditors leave no stone unturned when it comes to assessing your system’s controls. One of the key requests that often catches people off guard? A detailed list of users and their role assignments. It might seem like a straightforward request, but it serves a crucial purpose in evaluating your organization’s compliance and risk management.

Let’s dive into why auditors ask for this information, why it matters, and how you can easily generate this report in Sage Intacct.

Why Do Auditors Care About User Access?

ERP systems like Sage Intacct are the backbone of financial and operational processes, so user access and role assignments are critical to maintaining system integrity. Here’s why auditors prioritize this data:

-

- Segregation of Duties (SoD):

Auditors are on the lookout for potential role conflicts. For example, if a user has the ability to both create vendors and approve payments, that’s a red flag for fraud risk. Proper segregation of duties ensures no one person has unchecked control over a process. - Access Controls:

The principle of “least privilege” dictates that users should only have access to the parts of the system necessary for their job. Auditors assess whether your user roles align with this best practice. - Regulatory Compliance:

Compliance frameworks like SOX, GDPR, or industry-specific standards often mandate robust user role management to safeguard sensitive data and prevent unauthorized actions. - Accountability and Transparency:

A clear audit trail of who has access to what, and what actions they’ve performed, is essential for accountability. Auditors rely on this to trace critical activities back to the right users.

- Segregation of Duties (SoD):

What Exactly Are Auditors Looking For?

When auditors ask for user and role information, they typically want:

User Access Report: A list of all active users in the system.

Role Assignments: Details about the roles assigned to each user and what those roles allow.

Role Descriptions: A breakdown of what each role does within the ERP system.

Building a User Access and Role Report in Sage Intacct

The good news? Sage Intacct makes it easy to generate the kind of detailed user access report that auditors love. Here’s a step-by-step guide:

-

- Navigate to Custom Reports- Go to Reports > All > Custom Reports > Add

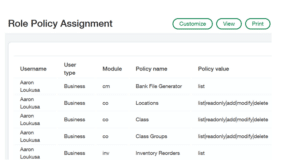

- Create a Role Policy Assignment Report- Step 1: Select Role policy assignment as your primary data source. Step 2: Select relevant columns. In the example below I’ve selected Username, User type, Module, Policy Name & Policy Value. There are over 50 columns that you can add in a Role Policy Assignment Report.

- Add additional filters, sort or prompt the report- Steps 3 through 10 of the custom report writer allow for sorting, prompting, filtering & grouping. Modify settings as necessary.

- Save & Run your report- Name and save your report. Then run your report.

User access reports might seem tedious, but they’re a powerful tool for maintaining control and transparency in your ERP system. By understanding what auditors are looking for and preparing in advance, you can turn this process into an opportunity to strengthen your system’s integrity.

3. End-of-Year Compliance and Tax Adjustments

Compliance with tax regulations is essential to avoid fines and maintain financial health. At year-end, businesses often make adjustments for compliance or tax purposes. Sage Intacct helps automate these adjustments, ensuring all regulatory requirements are met.

Set up compliance or tax adjustment journals with three steps:

1.Go to General Ledger – > Setup – > Configuration

2. In the GAAP and tax section of the Configuration, check the box for ‘Enable GAAP adjustment journals’ and/or Enable tax adjustment journals.

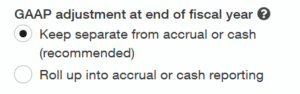

3. Review options in the GAAP adjustment at end of fiscal year section of the configuration. It’s recommended to keep the default selection of ‘Keep adjustments separate from accrual or cash.’

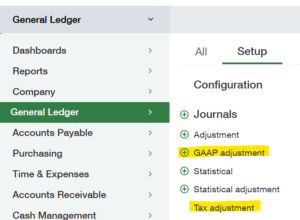

Once configured, add your compliance and/or tax adjustments journal types via General Ledger > Setup > Journals > Tax adjustment or GAAP Adjustment.

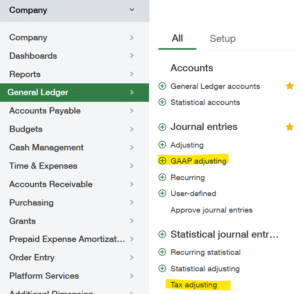

Create adjusting journals via General Ledger > All > Journal Entries > GAAP adjusting or General Ledger > All > Journal Entries > Tax adjusting.

4. Subledger vs. General Ledger Reconciliation

Reconciling your subledger (e.g., accounts payable, accounts receivable) with the general ledger (GL) is a critical step to ensure your financial records are accurate. Sage Intacct’s Customer Aging, Vendor Aging & Trial Balance Reports make year-end Subledger to General Ledger comparisons easy.

How to Perform Subledger vs. General Ledger Reconciliation in Sage Intacct:

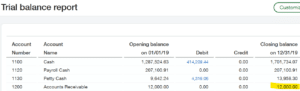

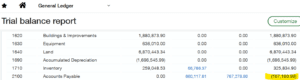

Run a General Ledger Trial Balance via General Ledger > All > Trial Balance to view your year-end Accounts Receivable Control Account Balance.

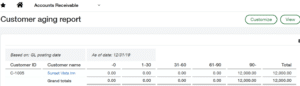

Run a Customer Aging via Accounts Receivable > All > Customer Aging > Report to view an AR aging report as of year-end.

Run a General Ledger Trial Balance via General Ledger > All > Trial Balance to view your year-end Accounts Payable Control Account Balance.

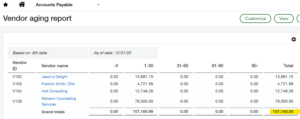

Run a Vendor Aging via Accounts Payable > All > Vendor Aging > Report to view an AP aging report as of year-end.

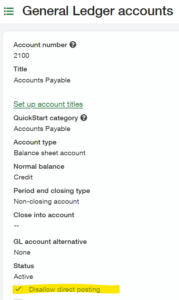

Intacct allows for the prevention of posting directly to the Accounts Receivable or Accounts Payable accounts via General Ledger > All > Accounts > General Ledger Accounts > Edit > Disallow Direct Posting. This feature prevents users from posting directly to any AP or AR control accounts.

5. Locking Periods in Sage Intacct

Locking periods in Sage Intacct is a critical process for securing finalized financial data and maintaining the integrity of your records. This feature ensures that once a period’s transactions are completed and reconciled, no further changes can be made, preventing accidental or unauthorized edits. Locking periods are especially important during the year-end close as it safeguards your historical financial data, enabling you to focus on completing the current period’s tasks without disruptions.

How to Lock Periods in Sage Intacct:

-

- Navigate to the General Ledger module in Sage Intacct.

- Select the Close Periods option and choose the desired period.

- Use the Lock Period function to restrict edits to the period while keeping it open for viewing.

6. Closing Periods in Sage Intacct

Closing periods finalizes all financial activities for a specific time frame, ensuring no additional transactions can be recorded. It provides a clear cutoff for financial reporting and establishes an accurate foundation for the new fiscal year.

How to Close Periods in Sage Intacct:

-

- Navigate to the General Ledger module and select the Close Periods menu.

- Choose the period you want to close and ensure all transactions for that period are posted.

- Use Sage Intacct’s checklists to verify that all reconciliations, adjustments, and approvals are complete.

- Confirm and close the period to finalize.

Why Choose Sage Intacct and CBIZ?

Closing the books at year-end is an essential and complex task for any business. By integrating Sage Intacct’s powerful accounting and ERP features into your end-of-year procedures, you can automate key processes, gain real-time insights, and collaborate seamlessly—turning a typically difficult process into an efficient workflow.

At CBIZ, we understand the importance of a smooth year-end close, which is why we provide customized solutions tailored to your unique business needs, ensuring you get the most out of Sage Intacct. Our team of certified Sage consultants has the expertise, resources, and proven methodology to support a more streamlined and effective year-end close.

To learn more about how your business can simplify your year-end processes with Sage Intacct, email us.