As businesses grow, their financial management needs become more complex. While QuickBooks serves well for early-stage companies, its limitations become apparent as organizations scale. Managing intricate financial processes, accessing real-time data, and handling multi-entity operations can overwhelm systems that aren’t designed for growth.

For finance teams facing rising demands, a scalable solution is no longer a luxury—it’s a necessity. The right accounting platform can drive efficiency and support business success, rather than hinder it.

That’s why many small and medium-sized businesses (SMBs) are making the switch to Sage Intacct’s robust, cloud-based platform. Built to address the challenges of growth, Sage Intacct equips finance teams with the tools to work smarter and faster.

Here are seven key reasons businesses choose Sage Intacct for their financial management needs.

1. Automation of Manual Processes

QuickBooks often forces accounting teams to rely heavily on spreadsheets and manual workarounds. This increases the risk of data entry errors, complicates workflows, and wastes valuable time and resources. Tasks like invoicing, expense management, and reconciliations become error-prone and tedious, delaying critical reports and complicating budgeting.

Sage Intacct automates these core financial processes, reducing errors and streamlining workflows. With features like automated billing, accounts payable workflows, and bank reconciliations, finance teams can focus on strategic initiatives that drive business growth.

2. Integration with Other Systems

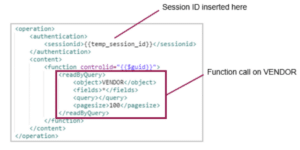

QuickBooks’ limited integration capabilities can lead to disconnected systems and data silos, making it difficult to maintain consistency across departments. In contrast, Sage Intacct’s open API allows seamless integration with a wide range of best-in-class tools, including CRM platforms, payroll systems, and industry-specific applications.

This connectivity creates a unified tech ecosystem, enhancing efficiency, improving data accuracy, and eliminating duplicate entry, empowering businesses to operate more smoothly and effectively.

3. Advanced Reporting and Analytics

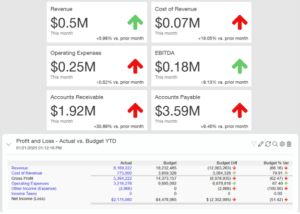

Modern finance teams need more than basic reports. Unlike QuickBooks, Sage Intacct offers robust reporting and analytics tools, giving businesses real-time visibility into their financial performance. Custom dashboards and in-depth reports empower decision-makers with actionable insights to drive strategic growth.

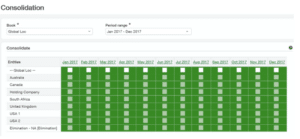

4. Streamlined Multi-Entity Management

Managing finances for multiple entities is challenging with limited tools. QuickBooks often requires manual consolidations, which are time-consuming and error prone. On the other hand, Sage Intacct simplifies multi-entity management by automating consolidations, standardizing processes, and centralizing reporting. This saves time and reduces errors, giving finance teams more control and efficiency.

5. Compliance and Audit Readiness

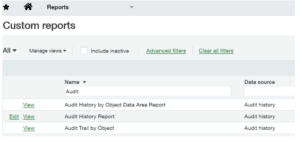

As compliance requirements grow more complex, businesses need reliable tools to meet regulatory standards and prepare for audits. Sage Intacct simplifies this process with built-in compliance features and detailed audit trails, reducing the risk of costly errors.

Designed to be GAAP-compliant and audit-ready, Sage Intacct adapts to evolving regulatory needs while maintaining secure and accurate financial records. This makes audits more manageable and ensures your organization remains compliant and confident.

6. Intuitive Interface and Customization Flexibility

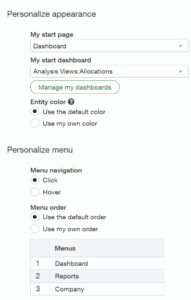

Sage Intacct’s user-friendly interface simplifies financial management while offering robust customization options. Unlike QuickBooks, Sage Intacct allows businesses to tailor dashboards, reports, and workflows to fit their unique needs.

These customization features enable finance teams to adjust views, streamline processes, and stay organized as business requirements evolve. The intuitive design ensures teams can work efficiently and focus on strategic priorities, boosting productivity across the board.

7. Scalability for Growing Businesses

QuickBooks often struggles to meet the needs of businesses experiencing growth. Sage Intacct provides a scalable platform that accommodates increasing transaction volumes, complex financial workflows, and additional users—all without slowing down. Whether you’re expanding globally or managing multiple locations, Sage Intacct’s scalability ensures your financial system grows alongside your business.

The Bottom Line

Outgrowing QuickBooks is a natural progression for SMBs seeking to scale and optimize their financial operations. Sage Intacct delivers the advanced functionality, automation, and scalability needed to support your growth journey. For finance teams, this means less time spent on manual processes and more time focusing on strategy and innovation.

Ready to Make the Move?

Migrating to a new financial system is a big decision—but you don’t have to navigate it alone. Selecting the right Sage Intacct partner makes all the difference in ensuring a seamless transition.

With over 30 years of experience and a proven methodology, CBIZ CompuData specializes in helping businesses successfully transition to Sage Intacct. Our certified Sage consultants provide the expertise and resources to guide you through every step of the process, ensuring you maximize the benefits of this powerful platform.

Contact us today to learn how Sage Intacct can transform your financial management and support your business’s growth.